COVID19 in the Automotive Space – What Can We Learn from The Last Financial Crisis?

Alex Melen

Co-Founder

As we try to navigate the new post-COVID19 world, it’s important to look back on previous nationwide and global catastrophes to help guide us in today’s ever-changing world. As with any major catastrophe, it’s important to remember the 3 pillars:

- Respond – Take early & immediate action to recognize sudden shifts in consumer behavior and lay the foundation for a future recovery.

- Rebuild – Monitor signals to capture ever-changing demand.

- Reframe – Adjust your business to the new trends, behaviors and demand patterns to build long-term business resilience to success.

Where are we now? As I write this in August 2020, I believe we are in the rebuild stage and have to remain both vigilant and agile in both marketing and business practices. However, I do think that we’ll be moving into the reframe phase very soon and businesses will need to make drastic changes to their operations to remain relevant.

2008 Financial Crisis

As we try to make sense of COVID19 and learn how to adapt, perhaps the most compared time period to now is the 2008 Financial Crisis. Mostly because it’s the most recent, and to many, appears to be the most similar. Although there are some similarities, let’s take a look at how these two crises are different for the automotive space. In the automotive space specifically, the 2008 Financial Crisis was primarily a demand shock, while COVID-19 is more of supply shock. In fact, a J.D. Power survey in June found that 74% of US auto shoppers remained in market during COVID-19 (compared to 31% in 2018).

“There are consumers who want to buy, have the ability to buy, but are not able to, so we are going to see pent-up demand” – Thomas King, President J.D. Power Data and Analytics.

Of course, we did have more extreme “shock” in mid-March to May 2020. Using search volume as a proxy for demand, we saw a 25-35% drop as consumers shifted priorities to groceries and disinfectants. However, starting in June, J.D. Power reported 8 consecutive weeks of increases in automotive sales.

What we saw during COVID-19 that we didn’t during the 2018 Financial Crisis was a huge drop in production & supply. In fact, Goldman Sachs reported just 25% of US Assembly plants were open in early March as still being open in April. To compound that, many plants that were allowed to re-open by July weren’t able to because of summer holiday schedules that weren’t easily changeable – prolonging the downtime. Still, the expectations are that factories and many businesses will be re-opened to full, or near-full capacity by Q4 2020 and beyond.

“As industries are gradually brought back online, that should produce an improvement in economy growth that could be “unprecedented” for the U.S.” – Jan Hatzius, Chief Economist, Goldman Sachs.

Continued Uncertainty

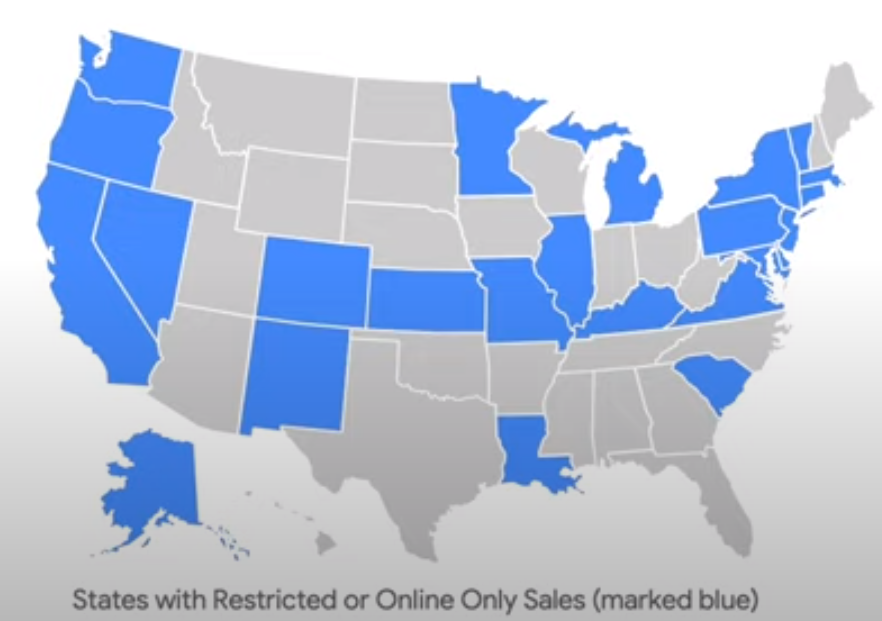

Although there has been some optimism in the last few weeks – there is still a great amount of uncertainty that is keeping us from going into the Reframe stage. In fact, as recently as last month 75% of car sales were in states that had some kind of restriction on automotive sales.

Unknowns

Driving the uncertainty are a couple of big unknowns:

- Demand: When will consumer confidence return to pre-COVID level for discretionary spending for large purchases such as new vehicles?

- Unemployment: A strong correlation exists between unemployment levels and vehicle sales. When will unemployment start to rebound?

- Confidence & Safety: When will consumers feel comfortable with visiting dealerships?

- At-Home Shopping: How can you meet the new expectations for digital retail experiences?

- The state of COVID19: With some states showing a resurgence, nobody knows the exact impeding affects, possible close-downs and the effects of the re-opening of the school systems.

- Change in population centers: Will the population shift from the urban centers continue? Will people’s aversion to public transportation continue? Will this push automotive demand or will the trends reverse?

What Should You Be Doing?

Perhaps the biggest correlation to the 2008 Financial Crisis is the stages of recovery and the response from businesses. Coming out of the “Respond” stage and into the “Rebuild” stage, we need to stay vigilant to changing trends, regulations and consumer behavior. It’s still too early to tell on the longer lasting affects of COVID and if consumer behavior will permanently change.

Just like in 2008, it’s unfortunately a wait-and-see game while making sure your business is prepared and is able to act quickly to the ever-changing unknowns. As we hopefully wrap up this phase in the coming two quarters, the priority will shift to rebuilding for the new normal and to meet the now-changed expectations and shopping behaviors of consumers.